Key Cord Cutting Statistics and Trends

Cable TV once dominated American living rooms. Over the last 15 years, streaming and better internet speeds have changed that. More households are canceling cable, choosing streaming services or free over-the-air TV instead. This shift, known as cord cutting, continues to reshape how people watch TV and how media companies compete.

What is Cord Cutting?

Cord cutting means canceling a traditional pay-TV subscription (cable or satellite) and replacing it with alternatives:

- Over the air (OTA): Free broadcast channels with an antenna (e.g., ABC, CBS, FOX, NBC, PBS, and local stations).

- Over the top (OTT): Internet-based streaming services for on-demand and live TV (e.g., Netflix, Hulu, Amazon Prime Video, YouTube TV, Sling TV).

Some people also drop home phone service as part of the move.

Why Should the Cord-Cutting Trend Matter to You?

Cord cutting affects content creation, advertising, sports rights, and broadband strategy. Networks are losing viewers, advertisers are shifting budgets, and streamers are racing to secure exclusive shows and live rights. For consumers, this shift is about price, convenience, and choice.

BroadbandSearch reports on TV and internet trends to help people compare options and make informed choices about how they watch and connect.

Key Cord Cutting Statistics and Trends

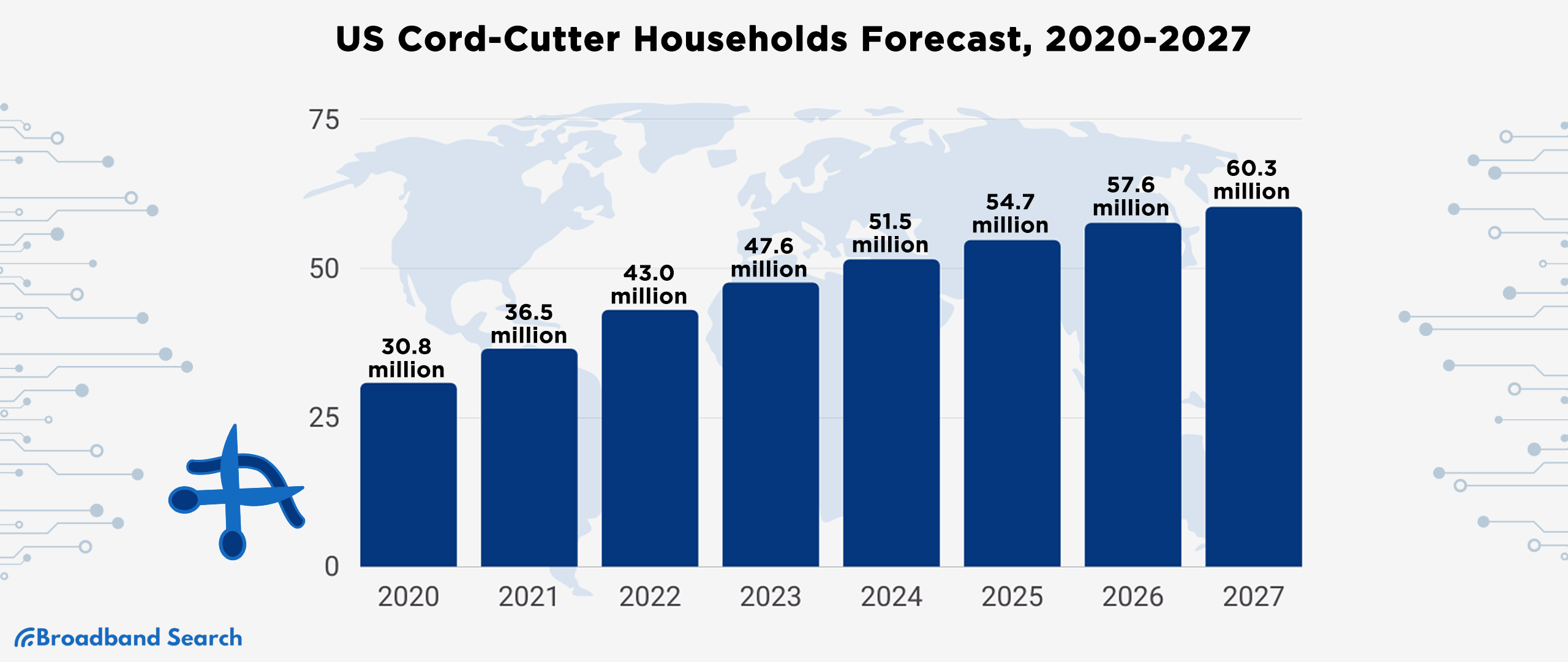

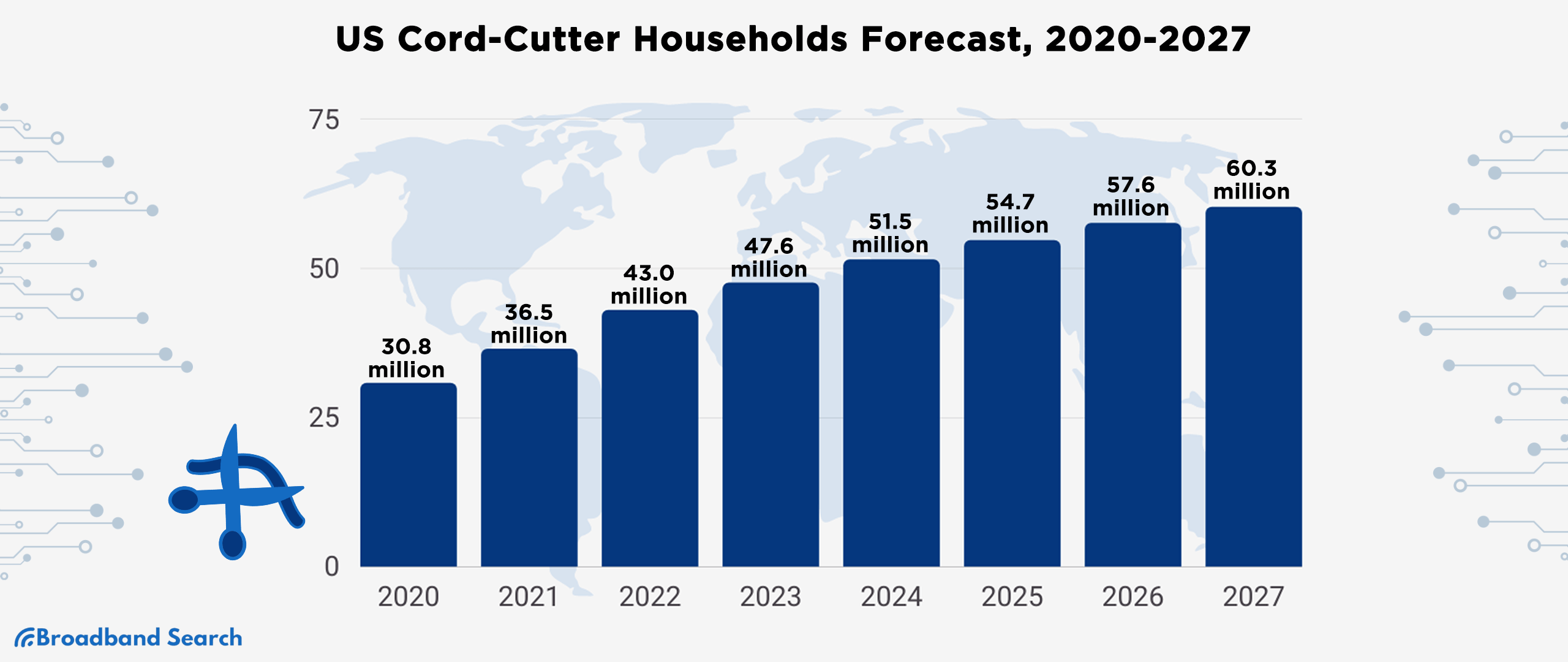

- Millions Are Cutting the Cord Each Year 4.9 million people cut the cord last year.

- That brings the total number of cord cutters to 39.3 million, an 18.9% increase year over year.

- Growth remains strong, though the rate of change is slowing as the base gets larger.

What it means: Cord cutting is no longer niche. It’s a mainstream choice that keeps expanding.

Cable Has Lost Around 25 Million Subscribers Since 2012

- U.S. pay-TV providers have shed roughly 25 million subscribers in the past decade-plus.

- Even with promotions and bundles, the long-term trend points down.

What it means: The decline isn’t a blip; it’s a steady reset of the TV market.

Fewer Than 6 in 10 US Households Are Expected to Have Cable by 2030

- Current adoption is about 81% of U.S. households.

- Projections suggest a drop to around 55% within a decade.

What it means: By 2030, it will be close to a coin flip whether a home has cable at all.

35 Million Americans Have Never Had Cable

- Many are younger adults, college-aged or recent grads.

- They grew up with streaming and see no need for cable when starting their own households.

What it means: For a big share of the next generation, streaming-only is the default.

Netflix Has More Viewers Than Cable and Satellite Combined

- While cable still has subscribers, Netflix leads in total viewers.

- Add other major streamers, and the viewing gap widens further.

What it means: Attention has shifted to streaming platforms. Where viewers go, ad dollars and premium content follow.

Over 2.3 Billion People Globally Have a Streaming Service

- The U.S. alone has about 750 million streaming subscriptions.

- Live TV streaming (YouTube TV, Hulu + Live TV, Sling TV, etc.) lets people access sports and local channels without cable.

What it means: Streaming is global, and live TV options erode cable’s last strongholds.

Cable TV Ratings Among 18–49-Year-Olds Are Down 29% in Six Years

- This is the most important advertising demographic.

- Ratings decline make it harder to justify traditional ad rates.

What it means: The audience advertisers value most is moving away from cable.

Nearly One-Third of People Over 50 Have Dropped Their Cable Subscription

- Even older viewers are changing habits.

- 61% of people over 50 now rely on online streaming for TV content.

What it means: Streaming isn’t just for younger audiences anymore.

Why Are People Cutting the Cord?

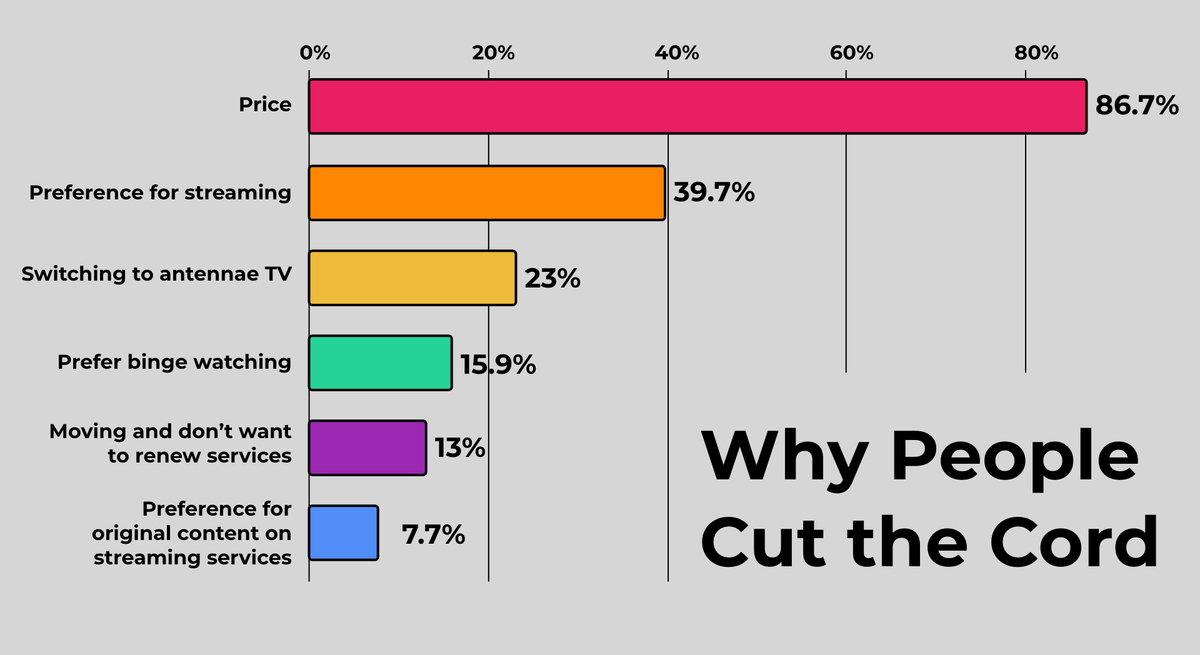

Price Is the Number One Reason for Cord Cutting

- The average cable bill is about $107 per month.

- 86.7% of cord cutters say price is their primary motivation.

What it means: Rising costs and fees push viewers to cheaper, more flexible options.

Only 34% of Subscribers Feel They Get Good Value from Cable

- Many pay for large channel bundles they don’t watch.

- The price-to-value ratio feels off, and frustration is growing.

What it means: Perceived value matters. Customizable streaming bundles feel fairer to many households.

40% Prefer Streaming Services Over Cable

- Benefits include fewer ads (depending on the plan), on-demand access, user profiles, and offline viewing.

- Popular services: Netflix, Hulu, Amazon Prime Video, Disney+, Max, and more.

What it means: Convenience and control outweigh the old channel guide experience.

About 23% Cut the Cord to Use Free TV with an Antenna

- Antennas cost roughly $50–$200 to set up.

- Viewers can get local channels and live sports without a monthly bill.

What it means: For casual viewers, OTA offers a simple, free alternative.

Original Programming Is Not a Major Driver Yet

- Only 7% say original streaming content is their main reason for cutting the cord.

- That could grow as streamers invest more in exclusive series, films, and live rights.

Originals help retention, but price and convenience drive most decisions today.

What Do Cord Cutters Miss About Cable?

More Than Half (52%) Don’t Miss Anything After Cutting the Cord

- 23% miss live sports.

- 22% miss local and national news.

Most don’t look back. For those who miss sports or news, live TV streaming and OTA can fill the gap.

The Future of TV is Flexible and On-Demand

Cord cutting accelerates because it solves two consumer pain points: price and convenience. Millions more are canceling cable TV each year, cable adoption is projected to fall below 60% by 2030, and younger households are starting life without cable at all. At the same time, streaming subscriptions have exploded worldwide, and live TV streaming undercuts cable’s last advantages.

For viewers, the trend means more control over what you pay for and how you watch. For the industry, it means adapting business models, investing in streaming experiences, and competing harder for attention. Cable isn’t likely to disappear entirely, but the center of gravity has moved. Streaming is where audiences are, and the future of television now live.

FAQ

What kind of channels can you get over-the-air?

People often forget that they can hoist an antenna and pull in quite a bit of free programming. Not only is there the Big 4 of CBS, NBC, ABC, and Fox, but you can expect to find a PBS affiliate as well as a selection of random local programming. This lets you watch first-run shows as well as late night re-runs of classics.

What is the best free tv streaming service?

“Best” is a subjective term. It depends on whether you want live channels or on-demand and if sheer numbers of shows/movies are important. For example, Pluto TV has the most live channels with 250, but if it's a sheer “wall of content” you’re looking for, Tubi offers around 20,000 shows for viewing whenever you want.

What kind of antenna do I need to get over-the-air television channels?

Despite manufacturers’ claims to the contrary, the FCC says that any antenna that can receive analog signals will work to get these channels. In other words, you don’t need a digital or high-definition antenna. As to whether you can get by with a $50 outdoor antenna or need a $200 indoor antenna, it really depends on the physical environment around your house. You might prefer to start with the cheap version and then upgrade if it doesn’t work very well.

Why did my cable company stop offering the MLB (insert your favorite channel here) Network?

Did you ever wonder why the channels offered by cable companies go away and (sometimes) come back? It all has to do with licensing fees and negotiations (arguments) related to that. For example, we can assume that the MLB Network allowed its content to be included with cable company lineups for a specific price and a certain number of years. Once that time period expired, the channel would go away unless a new deal was struck. This is where trouble arises. It’s a pretty good bet that the MLB Network wanted a higher price per year to continue - higher, evidently, than cable companies wanted to pay.

What is the largest cable company in the United States?

Comcast, which was founded way back in 1948, has the most subscriptions with around 19 million. For comparison, there are 70 million total cable subscribers in the US. This means that Comcast accounts for around 27% of the market. Next in line is Spectrum with about 16 million subscribers.